Taking the same period, the Aggressive Portfolio has returned over 104%*, meaning clients invested since 2015 have more than doubled their original investment.

*Source: 30/09/2025 True Potential Investments. Net of Ongoing Charges Figure. With investing, your capital is at risk.

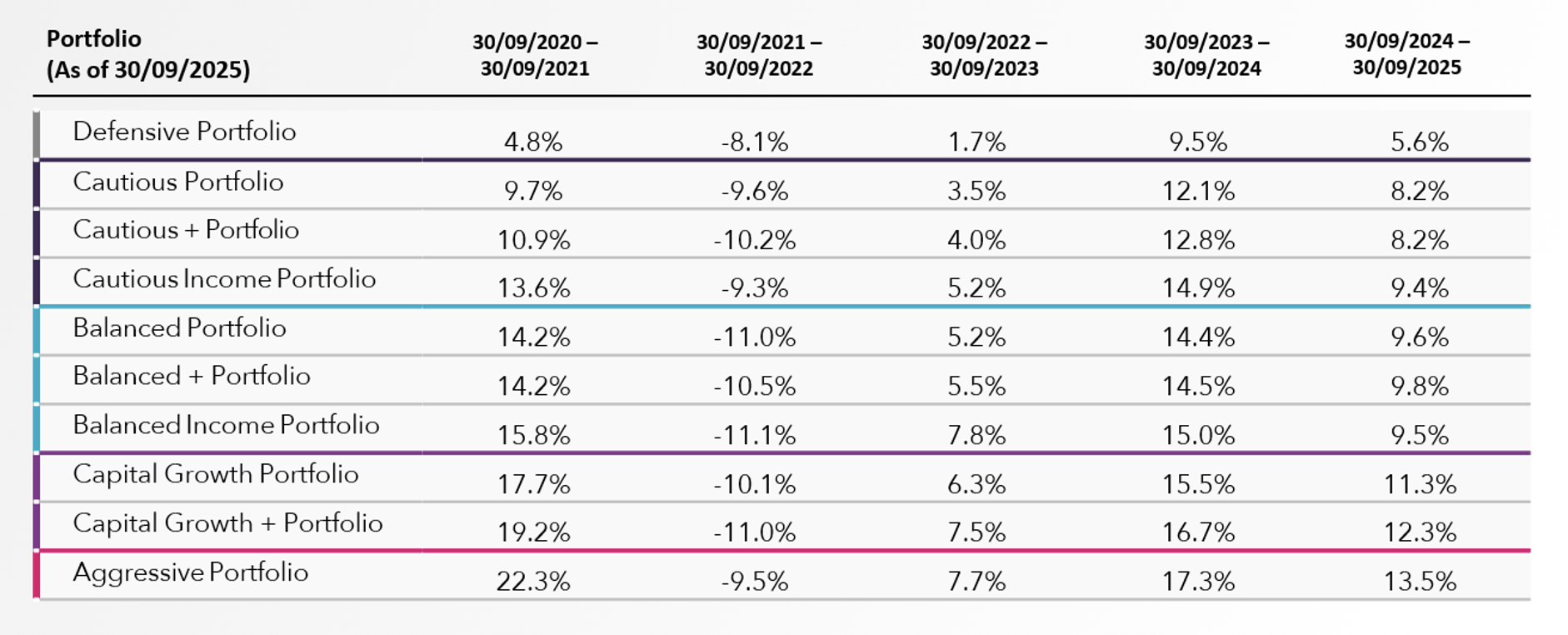

Performance information covers preceding 5 years and is based on complete 12-month periods.

Past performance is not a reliable indicator of future results.

It’s important to remember that, as with all investing, your capital is at risk. Investments can fluctuate in value and you may get back less than you invest.

A decade of innovation through Advanced Diversification

True Potential attributes this long-term success to its distinctive ‘Advanced Diversification’ approach –combining the benefits of multi-asset investing with dynamic, discretionary management. Diversification won’t stop you experiencing losses, but it can help spread your overall risk.

The strategy blends tried and tested multi-asset strategies, across geographic regions and investment strategies from world-renowned fund managers including Allianz, Columbia Threadneedle, Goldman Sachs Asset Management, Pictet, Schroders, SEI and UBS, as well as the True Potential Investments in-house Growth Aligned solution.

Supported by its proprietary technology, this framework allows the True Potential Investments team to monitor and adapt holdings in real time, ensuring portfolios remain optimised across regions, sectors, and asset classes.

However, good performance is never guaranteed. It’s important to remember with diversification that while there can be potential for greater returns, you could also get back less money than you put in.

Broadening access to investing

True Potential Investment’s ambition is to ensure the broaden of access to investments. With minimum investment from £1, simple and transparent fees, and its award-winning technology, the firm is opening up access to a wider range of clients and continuing its journey as it enters the next stage of growth as a business.

True Potential Investment’s impulseSave® technology – an award-winning, first-of-its-kind technology – enables clients to add to their investment from as little as £1, either by app or online.

Commenting on the Portfolio’s success over the past 10 years, Kevin Kidney, Head of Investments, said: “We’re proud of the continued performance of the Ture Potential Investment’s Portfolios. The 10th birthday marks a significant milestone, made all the more rewarding with top performance over the past decade.

“Combined with award-winning tech, our active engagement in Portfolios truly sets us apart, we continually adapt and reshape the Portfolios – often against that of the market – and can then be agile from there as necessary.

“It’s this agility, which is a core value of our business, which helps us drive continued success across the board and across such a significant period. We look forward to continuing to deliver great outcomes for our clients for the next 10 years.”

The leading proposition is built on:

Advanced Diversification: Access to global experts with over 370,000 holdings to blend multi-asset investment strategies.

Investment expertise: All investment decisions made by in-house Investment Team.

Low minimum investment: Investments from £1, making investment more accessible.

Global reach: Over 9,000 investment professionals in more than 160 global locations.

Leading tech: Proprietary, award-winning tech including the impulseSave®.

24/7 tracking: Real-time access to Portfolio performance, online and by app.

Discussing the performance of the Portfolios for clients, True Potential Wealth Management adviser, Mark Reynolds, said: “Looking back over the past 10 years, I’ve been consistently impressed by the performance of the Portfolios. With top quartile across the board, relative to the ARC Peer Group, the outcomes for my clients have been outstanding. The blend of advanced diversification and world-class fund managers, mixed with transparency and client-focussed technology, has made a real difference. impulseSave® alone has been a game-changer – helping people to top up their investments in a way that’s easy and accessible.

“The impact has been clear for clients – I’ve seen one client retire early and another who uses True Potential to feel more in control and assess his long-term goals. It’s testament to the value of long-term strategy with a robust and well-managed solution like True Potential Portfolios.”

The Portfolios are established as one of the UK’s leading investments over the past decade, delivering positive investment performance, managing over £31 billion of in assets and becoming a trusted home to nearly 200,000 clients.

*30/09/2025 True Potential Investments. Net of Ongoing Charges Figure. With investing, your capital is at risk.

Past performance is not a reliable indicator of future results. Opinions, interpretations and conclusions represent the views of True Potential Investments at the date of publication and are subject to change. Forecasts are not a reliable indicator of future results.

With investing, your capital is at risk. Investments can fluctuate in value and you may get back less than you invest. This material is not a personal recommendation or financial advice and the investments referred to may not be suitable for all investors.

True Potential Investments LLP is authorised and regulated by the Financial Conduct Authority. FRN 527444. Registered in England and Wales as a Limited Liability Partnership No. OC356027

True Potential LLP is registered in England and Wales as a Limited Liability Partnership No. OC380771.